Tools for homebuyers

/Homebuyers, sellers, and real estate professionals are paying close attention to interest rates these days. In a changing market like the one we’re in, there are tools that can help buyers purchase a home despite rising rates. Keep in mind that even though rates are higher than we’ve seen for a while, they’re in the mid-single digits, which is still relatively low.

The buyer tools we’re referring to are Adjustable-Rate Mortgages (ARM) and Interest Rate Buydowns. They can be the game changer between landing the home you want … or walking away. For that reason, they’re worth a closer look.

What are Adjustable-Rate Mortgages and how do they work?

An ARM is exactly what it sounds like: the interest rate on the mortgage is adjustable. Depending on the program offerings and market conditions, ARM rates typically start .5% to 1% lower than fixed rates.

Your rate on an ARM is locked in for a fixed amount of time, typically five, seven, or 10 years. At the end of that period, the rate on your mortgage will increase if interest rates have increased. Conversely, if interest rates have come down at the end of your fixed rate period, you can consider a refinance and lock in your mortgage at a lower, more favorable rate.

What is an Interest Rate Buydown and how does it work?

In this scenario, money is paid upfront to decrease the buyer’s interest rate. The lower the rate, the higher the “fee” to acquire the discounted rate.

In our current market, we may be able to negotiate a Buydown on your behalf. Because homes are not selling as quickly (and spending more days on the market), the seller may be motivated to “buy down” your interest rate rather than reduce their asking price.

A closer look at the numbers

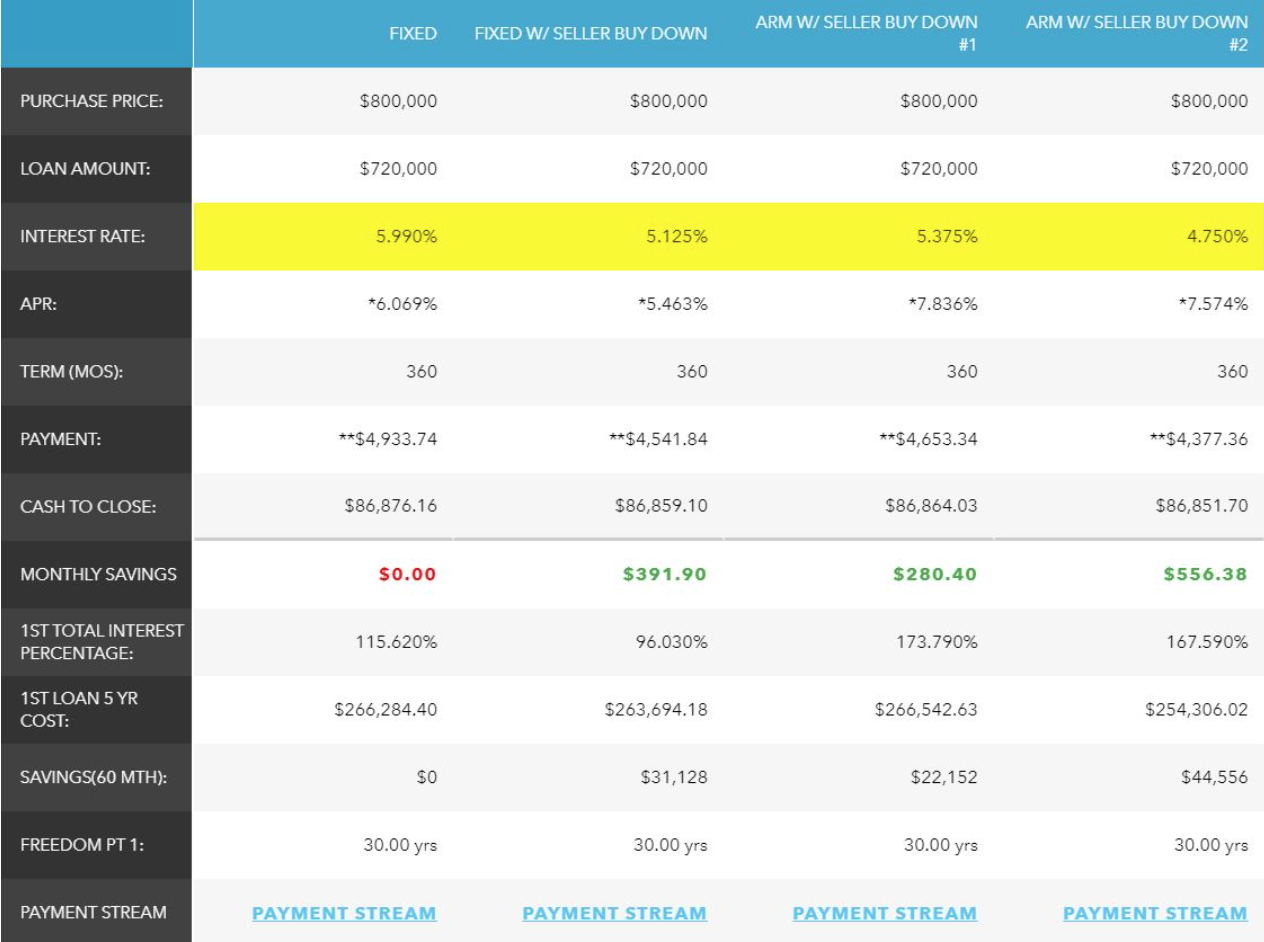

The table below provides an analysis of fixed rate mortgages, adjustable-rate mortgages, and an ARM with seller buydown. Laura Hebert with Prodigy Home Loans put together these scenarios.

While it’s important to get an actual loan estimate from your Loan Officer, these scenarios show why allowing us to negotiate a more favorable interest rate could work to your advantage.

Give us a call. We’re here to make sense out of mortgage options, help you weigh the pros and cons, and potentially negotiate a lower interest rate to get you in a new home.

Was this information helpful? Hit the heart and like our newsletter!